Bank Of Canada Cbdc Privacy - 2

A recent analytical staff note by the Bank of Canada on CBDCs has highlighted that higher privacy levels may come at a cost. The Bank of Canada has published a staff analytical note exploring privacy for central bank digital currencies CBDC.

Bank Of Canada Sees Cbdc Benefits As Payment Competition Innovation Ledger Insights Enterprise Blockchain

An anonymous token-based central bank digital currency CBDC would pose particular security risks.

Bank of canada cbdc privacy. According to the Canadian central bank report the risks of CBDCs basically revolve around accumulated balances. The Bank of Canada has been actively investigating designs use cases models and policy questions around the creation of a Central Bank Digital Currency CBDC. The posting also revealed some of the properties of the planned CBDC one of which is privacy.

Canadas CBDC Will Be Greener Than Bitcoin. They added that the bank has studied the environmental impact that crypto mining their currency has as well. Bank of Canada Comments on CBDCs.

CBDCs cannot have unlimited privacy Canadian deputy governor. The bank planned to develop one only as a contingency should the need arise. However Canadas CBDC would be run on a private blockchain thereby hindering transparency unlike the governments centralized model.

Canadas central bank the aptly named Bank of Canada or Banque du Canada for our Québécois readers BOC has released a set of comprehensive staff analytical notes considering the design security privacy and use of Central Bank Digital Currencies CBDCs. However we wont compromise on our principles and to give one example are not prepared to turn our back on digital privacy preserving technologies such as. We have an obligation to keep confidential all information by which you can be identified.

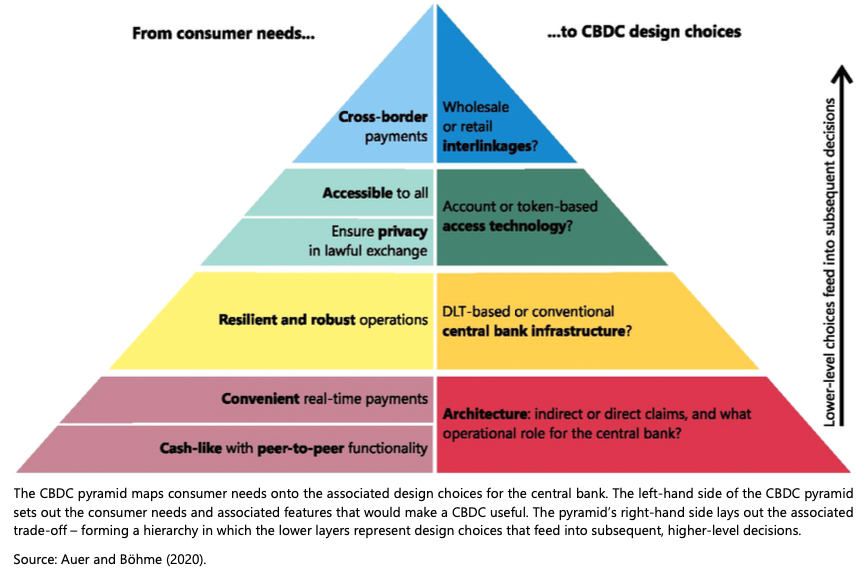

This note outlines what is technologically feasible for privacy in a central bank digital currency CBDC system. Any central bank-issued digital currency should have limits on how much anonymity it gives users a senior Bank of Canada official argues. Known privacy innovations such as Zero-knowledge proofs ZKPs have yet to prove their value.

Timothy Lane Bank of Canadas Deputy Governor said on Wednesday May 27 said that any digital cryptocurrency that may offer in the future will be more eco-friendly than bitcoin. As with cash privacy may be limited in the service of public safety priorities around money laundering terrorist. The Bank of Canada said earlier this year it wasnt planning to implement a digital currency any time soon.

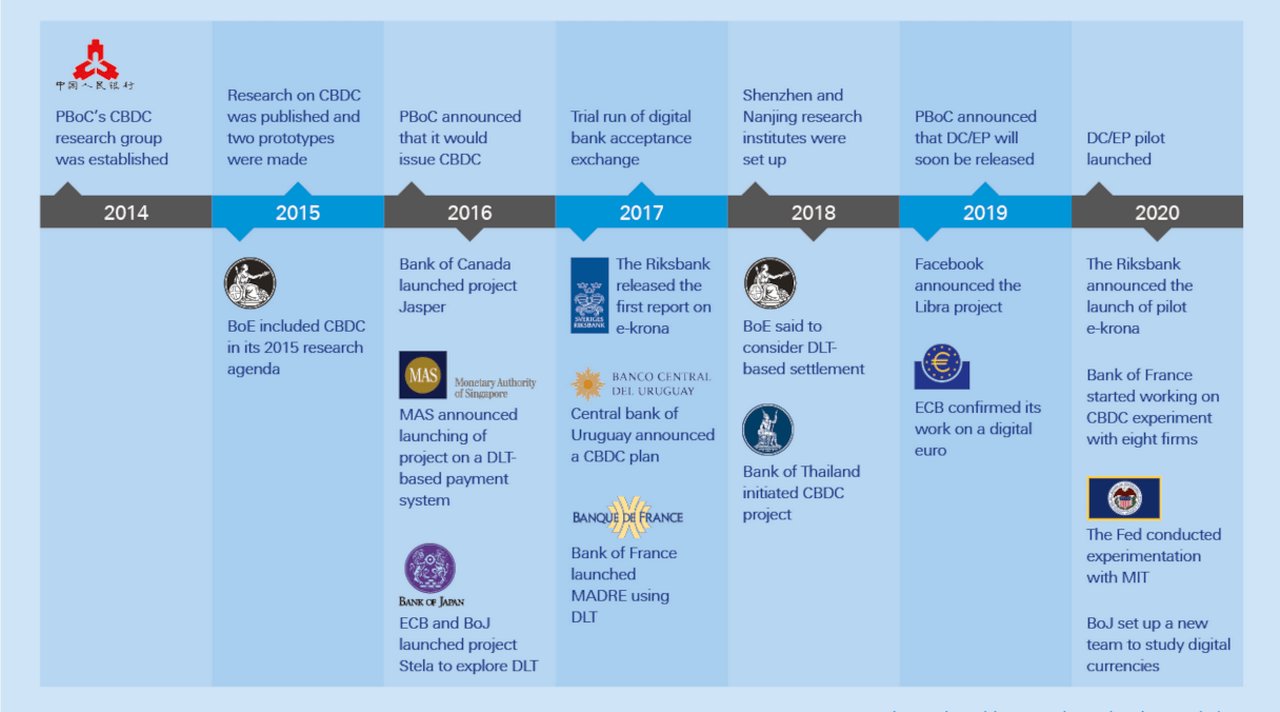

According to a recent report released by the Bank of Canada if central banks move forward with CBDCs there are clear risks if that system was anonymous. 1 To solicit additional ideas the Bank initiated the Model X Challenge in which it invited three independent university-based project teams to conduct exploratory design work on a CBDC in Canada. Between 2016 and 2018 as part of an initiative called Project Jasper the bank explored the use of distributed ledger technology DLT for clearing and settling of bank-to-bank payments as well as securities transactions.

Our attitude has always been that responsibility comes first and we have consistently imposed necessary restrictions even when it hurt our bottom line. Now Timothy Lane a deputy governor of the Bank says the pandemic may have accelerated some of the necessary preconditions for a potential CBDC. While not aiming for cash-like anonymity CBDC should be highly private yet meet the obligation to be compliant with anti-money laundering and other regulations.

The Bank of Canada has been a leader in the research and development of CBDC prototypes. The Bank of Canada recently delivered a report on the risks and benefits of a central bank digital currency. According to reports by the Bank of Canada around five percent of Canadians make use of decentralized crypto like Bitcoin and own it.

In its October 5 report The Bank of Canada wrote that digital currency CBDC based on anonymous tokens would pose a particular security riskThese risks it continued arise from how funds are gathered and stored how CBDC uses transactions and how different solutions such as e. A robust digital world often means less privacy. Privacy and the sensitivity of personal information.

The bank summarized possible privacy CBDC frameworks as it looks to advance research and development in this space. According to the job posting Canadas CBDC should protect user privacy though not to the degree that cash does remain accessible to those without bank accounts or mobile phones work when. Privacy in a CBDC.

It also outlined the pros and cons of zero knowledge proofs. Unlike Bitcoin that is completely decentralized CBDCs are centralized digital currencies and will be prone to central control brewing a lot of privacy concerns. We are committed to protecting any personal information we hold.

A new report released by the Bank of Canada has revealed that the bank believes Central Bank Digital Currencies can pose security risks to users. The bulk of the succinct paper highlights the trade offs between privacy which is seen as a public good and the need for disclosure required by regulations. This Privacy Policy outlines how we manage your personal information and safeguard your privacy.

A CBDC with the same level of privacy as traditional cash is highly unlikely. Speaking to Central Banking in a forthcoming interview deputy governor Timothy Lane says there would need to be a trade-off in terms of privacy. Digital currencies like CBDC wont be an exception but addressing these concerns early enough could make a lot of difference.

An anonymous token-based central bank digital currency CBDC would pose certain security. Bank of Canada research has established that there is a public good aspect to privacy in payments Garratt and van Oordt 2019. The Community Business Development Corporations CBDCs of Atlantic Canada recognize the importance of.

CBDCs may be good for international payments corporate loans and online commerce but theyll be bad for your privacy. Keep the Bureaucrats out of Your Wallet. The regulator wants to create a currency that will be highly private but still be compliant with AML and such other regulations.

The participating universities were McGill. CBDC must have the highest levels of security so Canadians can use it with confidence as they do our banknotes. CBDC privacy implications crucial.

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Cbdc Arms Race Canada Challenges Digital Dollar And Chinese Dcep

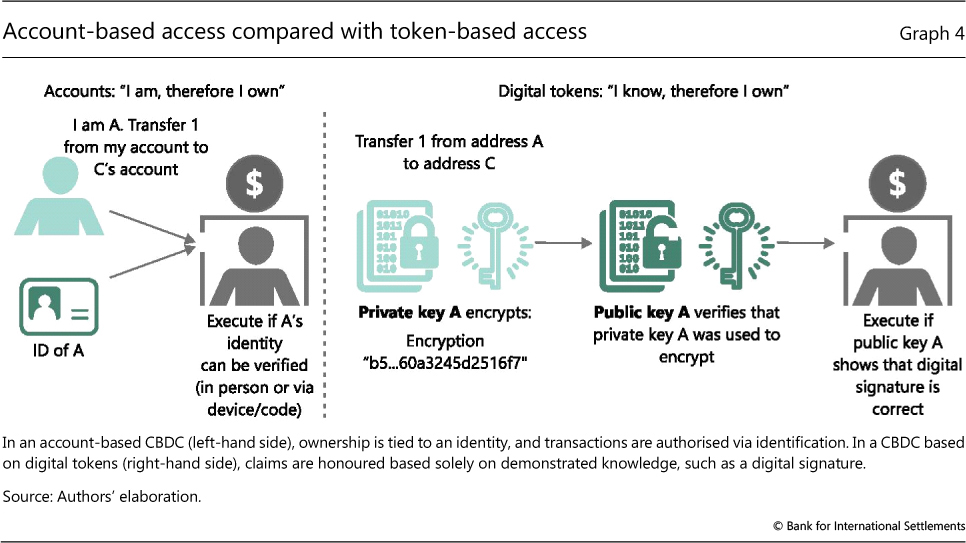

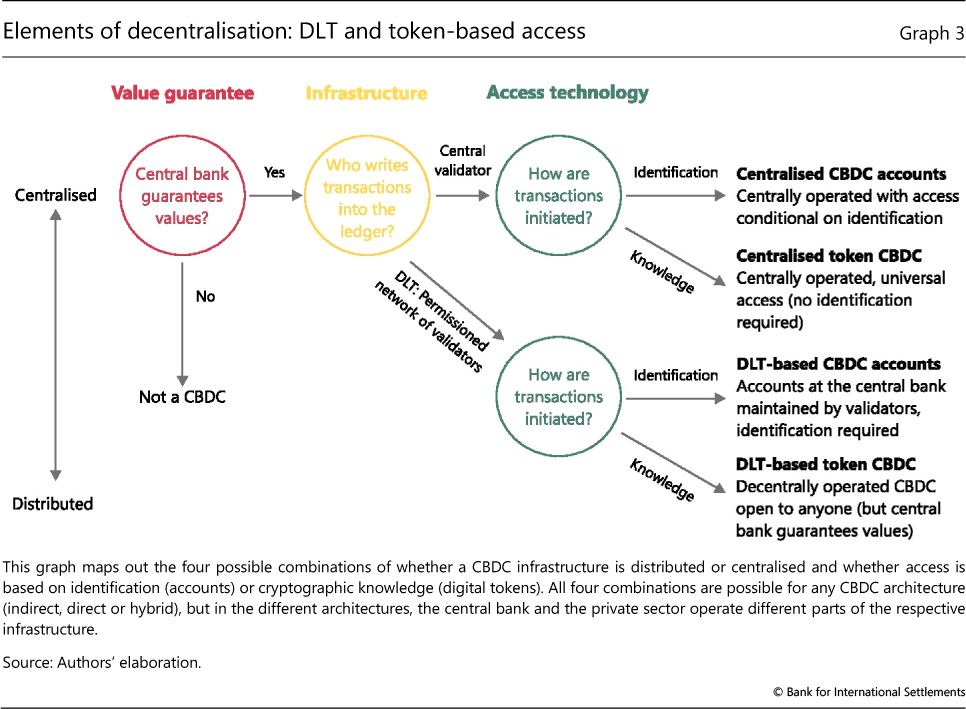

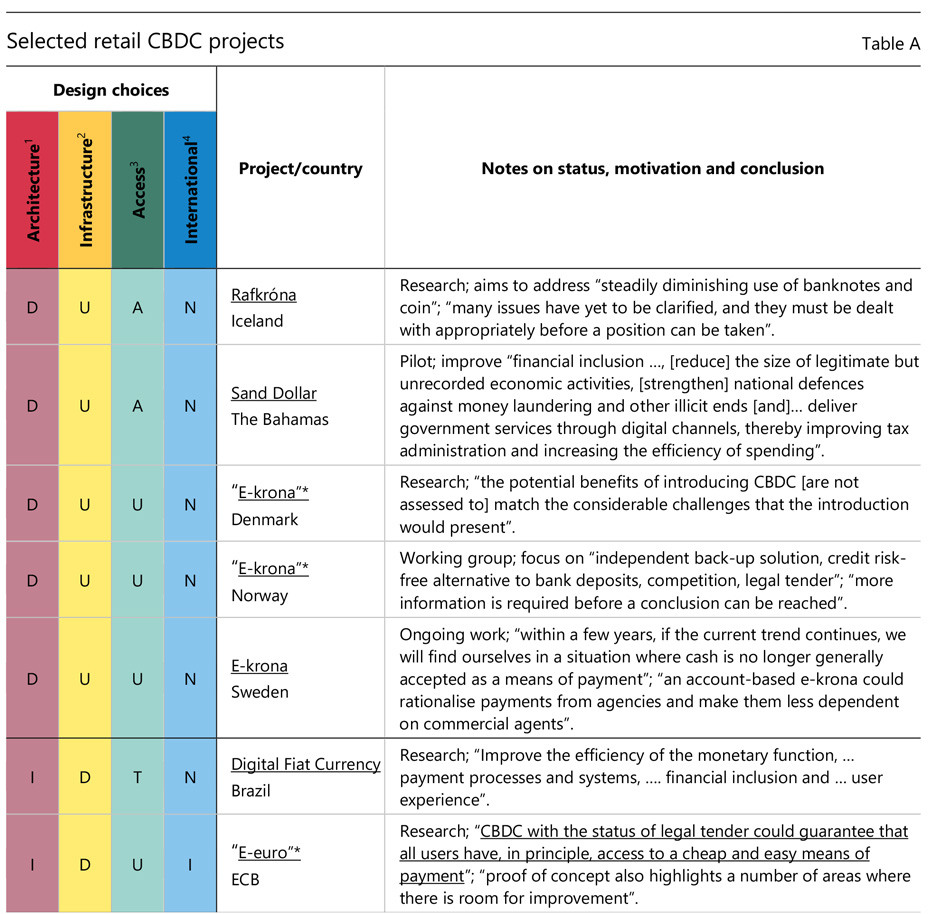

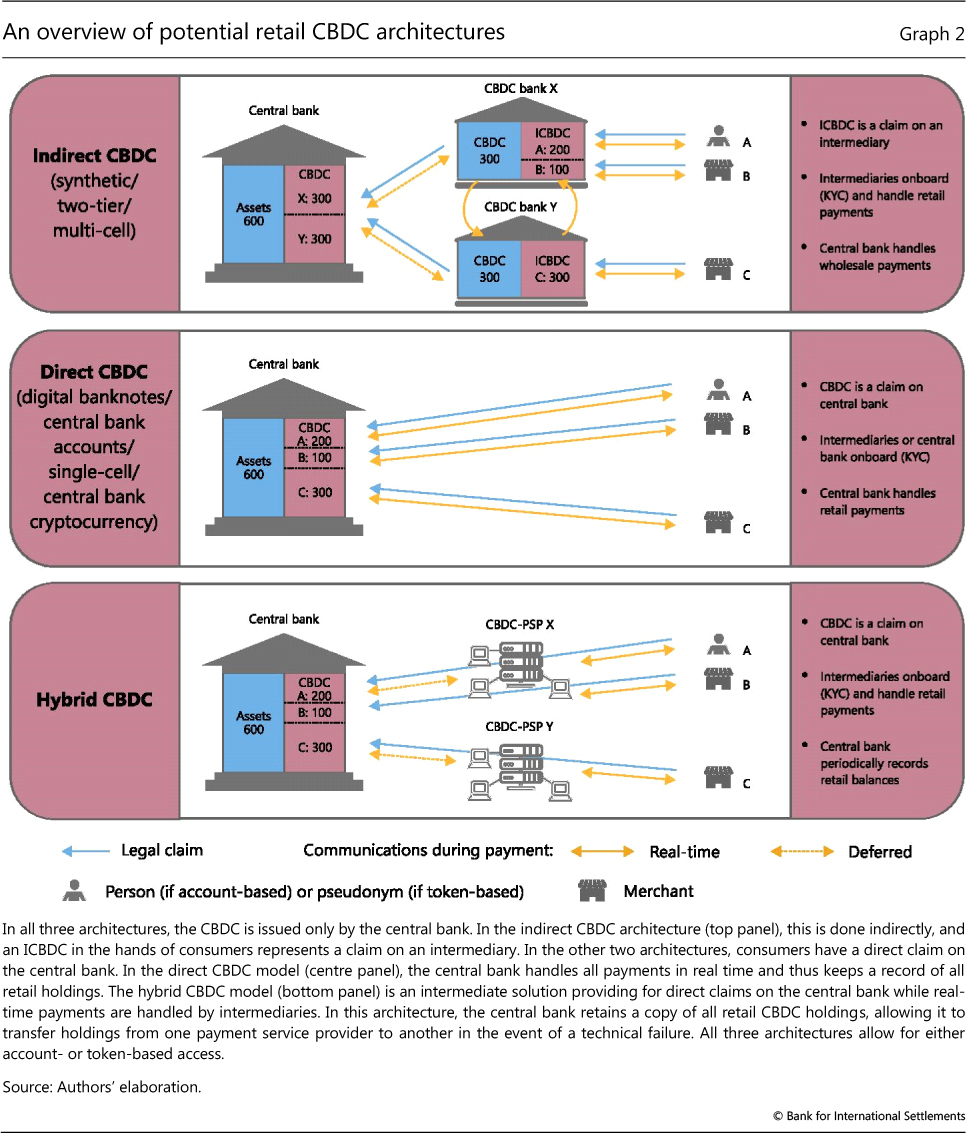

The Technology Of Retail Central Bank Digital Currency

Bank Of Canada Experts Say Cbdc Model Should Be Made Accessible Btcmanager

Digital Money Archives Schnapper Casteras Pllc

Canada Cbdc Probably Necessary For Competition Central Bank Says In Paper Coindesk

Cbdcs And Privacy Concerns Timestamp Magazine

A Survey Of Research On Retail Central Bank Digital Currency In Imf Working Papers Volume 2020 Issue 104 2020

Why The Rise Of The Cbdc Is Bad For Your Privacy Op Ed Bitcoin News

The Technology Of Retail Central Bank Digital Currency

Cbdcs And Privacy Concerns Timestamp Magazine

Bank Of Canada Reveals Cbdc Plans With New Job Posting Coingeek

The Technology Of Retail Central Bank Digital Currency

The Technology Of Retail Central Bank Digital Currency

Canada S Central Bank Explores Privacy V Regulation For Cbdc Concerns Re Zero Knowledge Ledger Insights Enterprise Blockchain

Central Bank Digital Currencies Are Definitely Coming But When Ctmfile

Central Bank Digital Currencies The Game Changers Deutsche Bank

Bank Of Canada Researchers Say Zero Knowledge Proofs Are Still Too Immature For Cbdc Use

Posting Komentar

Posting Komentar